Thought of the week – Blame big tech for the lack of IPOs

Here in the UK, there is an intense debate about the dearth of IPOs, but even in the US, ever more venture capital-backed companies are choosing to stay private for longer rather than IPO. And according to Florian Ederer and Bruno Pellegrino, there is a case to be made that the dominance of big tech companies has contributed to this trend.

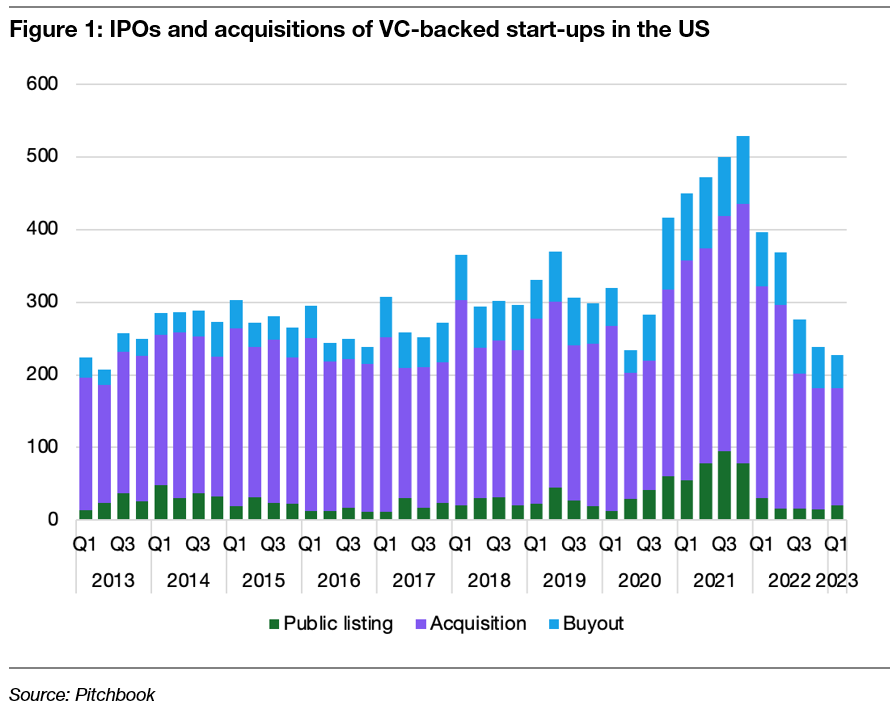

It is no surprise that we had hardly any IPOs in 2022. Inflation and interest rates were rising rapidly, and uncertainty was high. But even in 2023, the IPO market was slow to get off the starting blocks, though it is increasingly showing signs of life and launches are becoming more numerous. Nevertheless, the overall trend shown in the chart to the left is simple: more and more start-ups are choosing to sell themselves to larger competitors rather than go public.

What is driving this trend (at least partially) is the opportunity cost of going public, according to Ederer and Pellegrino. If a start-up decides to go public, it must compete with the big incumbents in its sector. This means it will face hurdles like technological compatibility, a smaller marketing budget, and other factors. In plain terms, the large incumbents can make life hard for you while your shareholders are demanding rapid progress in growth.

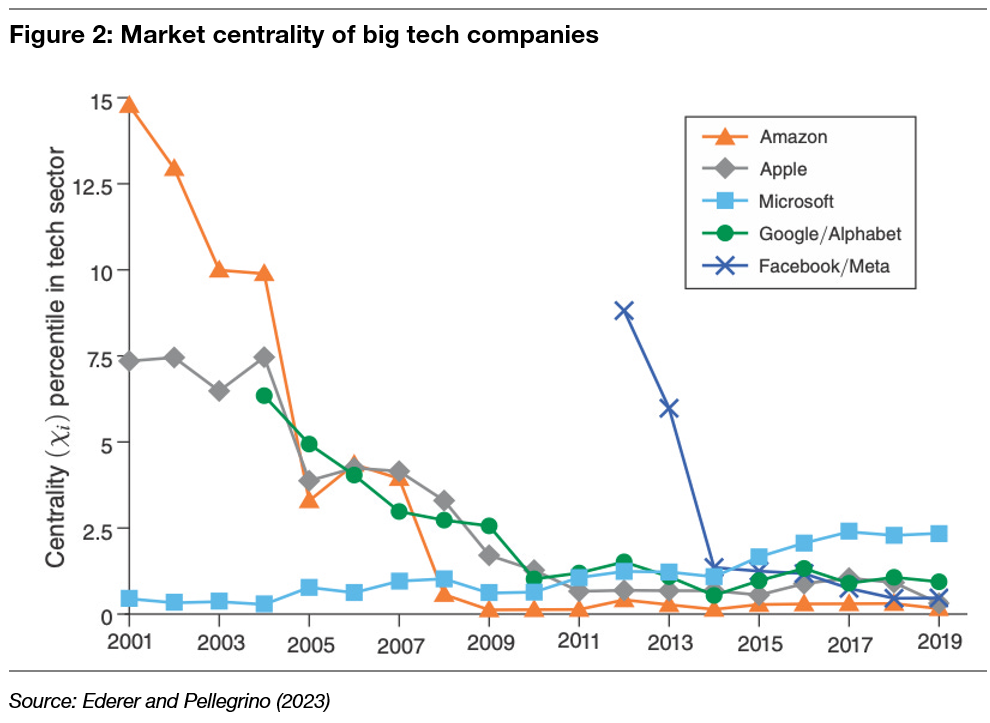

And the more entrenched a technology, the easier it is for the silverback gorilla in the sector to make life tough for disruptors. Look at the chart below, which shows the market centrality of large US tech companies. The lower the score, the more central their products are for a given industry and the harder it is to dislodge them and convince customers to switch to competitors. While Microsoft has suffered a small drop in market centrality (its moat has slightly narrowed) the others have seen their moats grow massively over the last 20 years.

Start-ups then have a choice. Go public and compete with these tech behemoths or sell out to them and grow within their ecosystem, backed by their enormous resources. No wonder many start-ups decide to sell themselves to large incumbents. And that, in turn, has a chilling effect on VC investments in start-ups in these sectors. I have discussed how large tech companies create a kill zone around them where nothing new can grow.

Of course, this is not the only reason why companies are increasingly reluctant to go public, but in some sectors, it contributes to the problem. If there is any good news coming out of the last two years of rising interest rates, it is that these tech mega-caps are increasingly strapped for cash and can’t just buy any and every new start-up anywhere.

Luckily, in 2022 and 2023, the opportunity costs of going public declined, which means we are more likely to see good start-ups come to the public market again.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.