Thought of the week – Trickle me, Elmo

Most of my readers will be familiar with the laughable concept of trickle-down economics. In 2023, only the economically illiterate or wilfully ignorant will advocate that cutting taxes for high-income households leads to stronger growth and prosperity for all…

The fact that trickle-down economics does not work was proven a long time ago, and that it is outright dangerous in a highly indebted country can be seen by looking at what happened when former UK Prime Minister Liz Truss tried to implement these policies in 2022. For a couple of weeks, the world treated the UK like a Banana Republic, and the cost of her 49 days in office runs into the billions and will mostly be shouldered by British taxpayers.

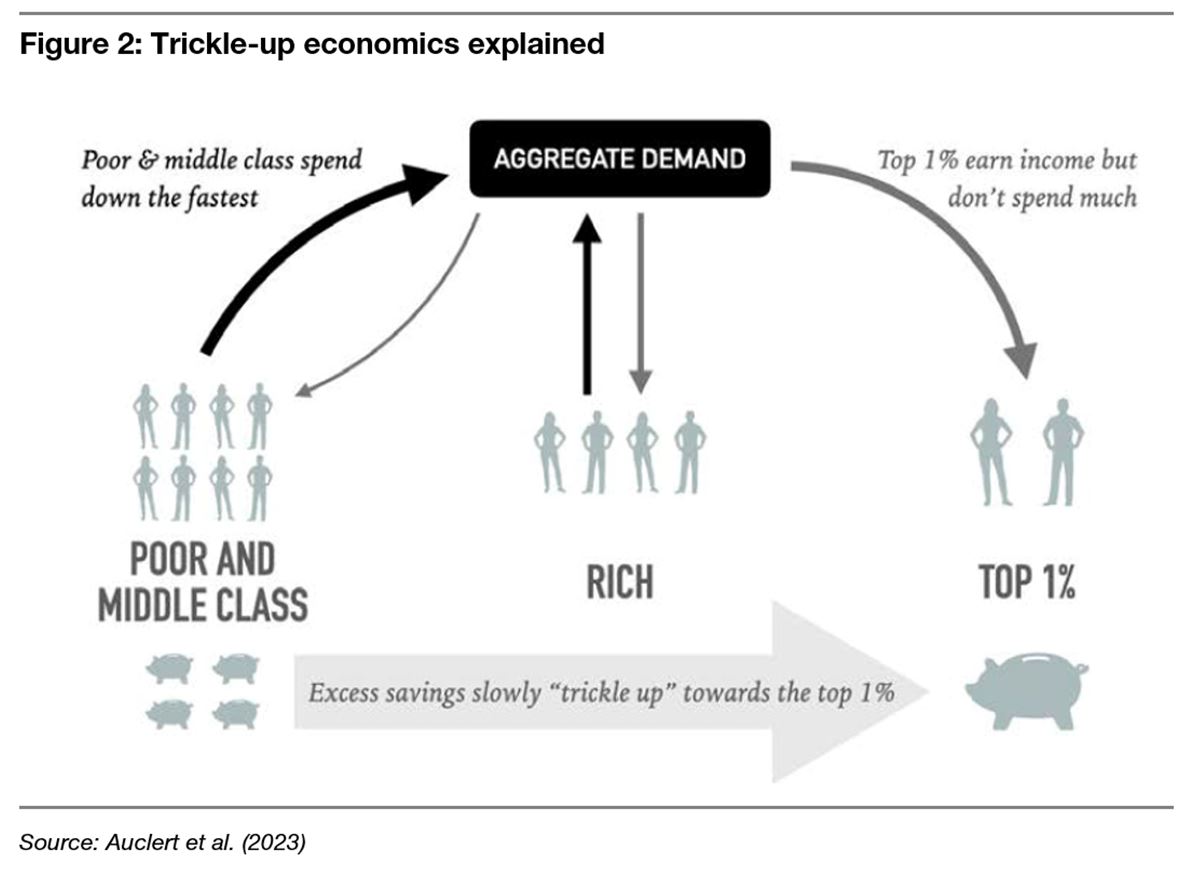

But, ironically, it seems that trickle-down economics wasn’t just a vacuous concept, it may literally be an upside-down concept of what is really going on in an economy. According to this paper, what really happens in the economy is trickling up, not down.

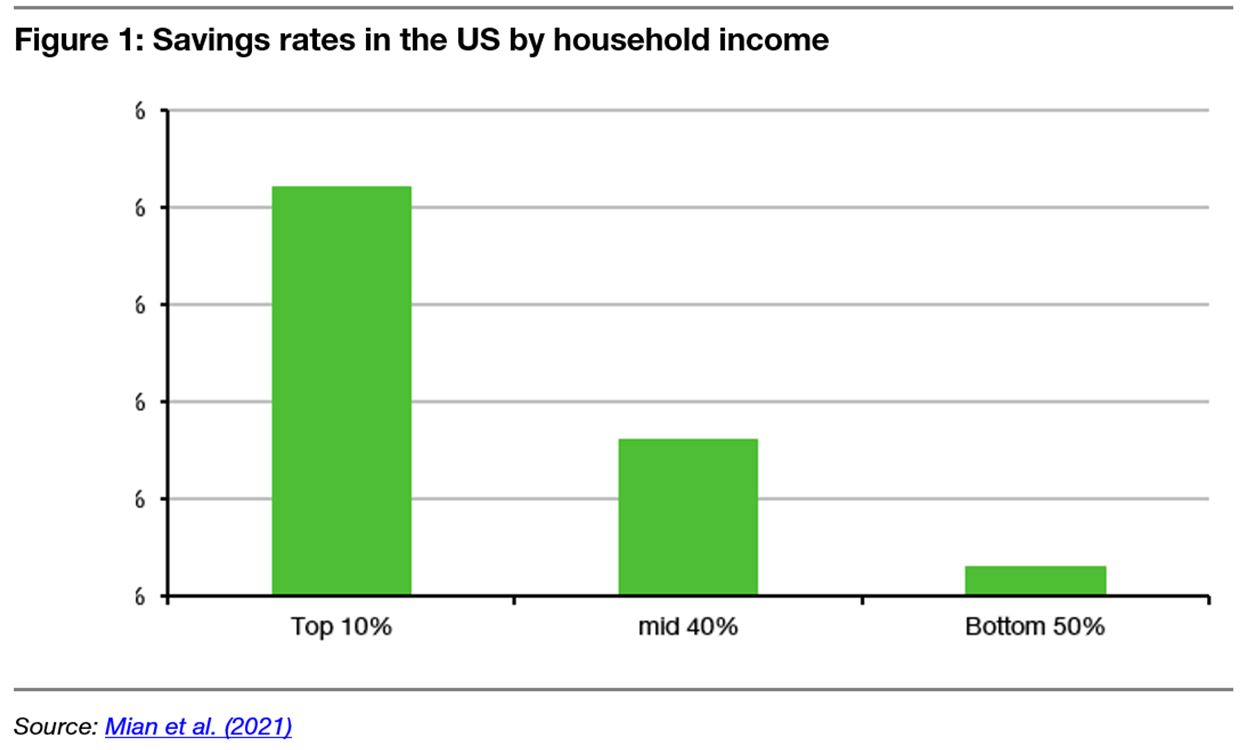

Imagine a situation where the government introduces a fiscal stimulus like the Covid stimulus plans enacted in most countries in 2020 and 2021. This government spending effectively puts money into people’s pockets and they can choose to spend it or save it. One important thing to realise is that the lower the income of a person who gets a stimulus cheque, the more likely it is this person will spend the money instead of saving it. Savings rates for higher-income households far exceed those of lower-income households. And this is not because the poor don’t know how to handle money, but because the poor simply can’t afford to save. They have essentially zero disposable income, and thus every bit of extra income needs to be spent on purchases of essential goods.

But what happens when poorer households spend their money? Companies that sell consumer goods make more money and their share prices rise. This not only boosts economic growth, it also increases the savings of shareholders. And shareholders are mostly found in the top 50% of the population by income. The higher up the income ladder you go, the more savings people hold in shares and the more their savings increase as poor people spend their extra income. In the end, money spent by the poor trickles up to the rich and enhances their savings, thus creating more inequality in an economy.

Thought of the Day features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.