Thought of the Week - Standard or ESG benchmark?

As ESG investing becomes more and more popular, investors are thinking about switching their benchmarks from a traditional index like the MSCI country indices or the FTSE indices to an ESG benchmark calculated by these companies or other providers. Alternatively, they may keep their benchmark indices in place but instead, invest in an ETF or fund that tracks an ESG benchmark. In both cases, the risk is that by investing with sustainability criteria in mind, the portfolio may start to underperform, especially if sectors like energy and mining start to rally.

Peter Jørgensen and Mathias Plovst from the University of Aarhus have thought about this problem and showed that in theory, it is possible to create options that would insure an investor against the risk of underperformance. They calculate that the insurance cost varies depending on the volatility of the traditional market benchmark and the ESG benchmark used and would come to somewhere between 0.5% and 2.7% per year.

But why would you buy such insurance? First of all, I find this annual insurance premium remarkably high. I am not sure I would be willing to give up between 0.5% and 3% of my performance every year just to avoid uncomfortable questions from my pension fund trustees. Instead, I would rather argue to change the benchmark indices and tracked benchmarks so that they are one and the same and there is no more risk of underperformance due to a discrepancy in performance that only exists on paper but not in reality.

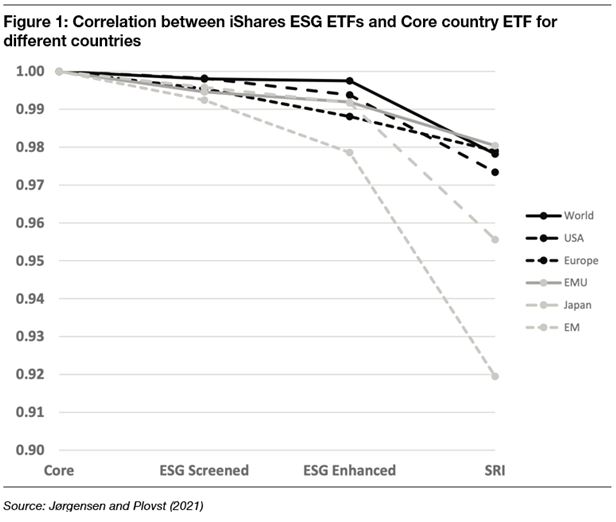

Besides, modern ESG indices are constructed in such a way that they closely track conventional indices. The chart below shows the correlation for different iShares ETFs based on different ESG indices with the corresponding iShares Core country ETF. In general, it is 0.98 or higher, i.e. almost perfect correlation.

A correlation of 1 does not mean that there can’t be a performance difference. The performance differences can happen and can be material, which is why the insurance premium would be so high. But I suggest pension funds and other investors should rather have a conversation about choosing the right indices as benchmarks than trying to track a conventional benchmark with an ESG product. There is no need to make your life as a portfolio manager more complicated than necessary.

Thought of the Week features investment-related and economics-related musings that don’t necessarily have anything to do with current markets. They are designed to take a step back and think about the world a little bit differently. Feel free to share these thoughts with your colleagues whenever you find them interesting. If you have colleagues who would like to receive this publication please ask them to send an email to joachim.klement@liberum.com. This publication is free for everyone.